On your financial statements, they should normally be placed in the sequence order given. When you put up your accounting software, you’ll want to comprise all appropriate accounts. Depended upon your kind of business, you will utilize many, but in all probability not all, of these account’s names. We have offered a list of usual general ledger accounts many businesses find helpful. The total sum of allover general ledgers debit balance should always be equivalent to the total sum of all general ledgers credit balance. When all journal entries are published, you can appear at the ending of the balance for each account. The separate entries in the general ledger are always from the entire columns of your assisting journals.

#Bank account general ledger software#

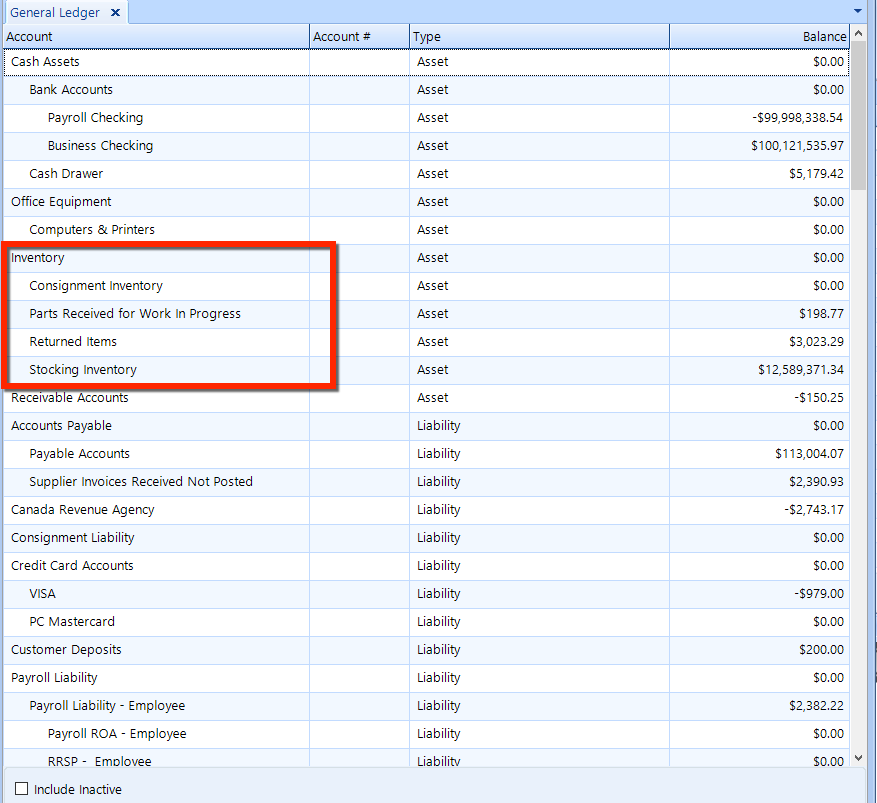

Your accounting software will put to one side space in the general ledger for every one of the general ledger accounts. There are also separate general ledger accounts for numerous items that don’t have their own sequence in the journals but are included in a “miscellaneous” row.įor instance Cash, Accounts Receivable, Accounts Payable, Sales, Purchases, Telephone Expenses, and Owner’s Equity are all examples of the general ledger account.

#Bank account general ledger trial#

But this duty will be clarified if we categorize the bills according to the pertinent expenses and file them according to from the starting of the year. We have designated all the bills in an isolated file, then we will have to find every bill monthly wise and then enter that head of payments and then dissimilitude the various expense. Over a phase of 1 year, we may want to scrutinize our expenses. Let us clarify this conception with the following illustrations: We pay monthly billings for credit cards, mobile phones, electricity, etc. Expenses are the costs of doing business, paying rent, employers, advertising, and other related items. Income comprises the total amount of money received by the business. Liabilities comprise outstanding debt the company is in debt to suppliers or investors. Assets comprise supplies and cash possess by the company. A general ledger must have four primary sections: Assets, Liabilities, Income, and Expenses. The main motive of a general ledger is to show present balances in key areas. A general ledger performs as a short summary of financial information about the company.

0 kommentar(er)

0 kommentar(er)